Good With Money: 3 Valuable Financial Stewardship Principles Every Homemaker Needs to Know

This is part 4 of the Homemaking 101 series. In this fourth and final part, we will explore some sound financial stewardship principles found in Proverbs 31. Part of being a biblical homemaker is learning to manage our household finances with wisdom, integrity, and generosity, and there’s much we can learn from the Virtuous Woman about how to do just that.

Biblical financial stewardship is a vast topic, but in this post, we will look at just three principles we see skillfully lived out by the Virtuous Woman, principles every homemaker needs to know and live by.

As I wrote this article, I asked several homemakers about their best money management tips and/or their greatest financial struggles. Their answers are insightful and practical; you’ll find their wisdom helpful and encouraging.

Note: I am not a licensed financial advisor, nor do I provide professional or legal advice. However, I am a homemaker seeking to learn and grow in biblical financial stewardship. Proverbs 31 holds a wealth of information about how homemakers can bless their families through wise money management and frugal, yet generous, living.

Principle 1: Manage Your Household Finances with Integrity

“The heart of her husband doth safely trust in her, so that he shall have no need of spoil.” (Proverbs 31:11)

The Virtuous Woman was trustworthy in every area of her life, including her handling of money. Learning to be honest and responsible with the money and resources God and others have entrusted to us is foundational to being wise and faithful managers of our household finances. All the tips, tricks, and hacks in the world won’t benefit us if are not honoring God by living with financial integrity.

Whether being honest with taxes, taking care not to hide purchases from one’s spouse, or avoiding irresponsible spending, homemakers have many areas to practice managing their household resources with honor. There’s lots of talk about financial freedom, but the most significant financial freedom anyone can have is knowing they are not in bondage to deceit or shame over reckless, hidden, or harmful money habits.

Becoming good with money starts with being faithful and trustworthy in all the little things. As you are, you will be able to wisely manage more resources for the glory of God and the good of others (1 Corinthians 4:2; Luke 16:10).

Financial Stewardship in Action:

Ask God to show you any areas where you may be tempted to be less than honest with your financial dealings, whether with your husband, at work, during shopping at a store, or any other financial situation. If there are any areas that God reveals to you, confess your sin to Him and anyone you may have wronged, and take steps to protect yourself from that temptation.

If deception and/or irresponsible spending has been an ongoing, embedded habit in your life, please seek a wise counselor and someone godly who can help keep you accountable. I recommend the ministry FaithFi (formerly Compass MoneyWise) as a great place to start looking for resources to help you navigate your finances with integrity and wisdom.

Sidebar: If you are married, you and your husband must work together with openness and honesty in your finances. One of you may be more adept at crunching numbers and keeping the income and expenses balanced, but you need clear communication. If one spouse controls the finances without welcoming insight and input from the other spouse, that is a serious red flag, and there may be deeper issues in your marriage that need to be addressed with wise counsel. Please seek help from a godly, trusted pastor or counselor.

Principle 2: Live Generously and Save Prudently

“She stretcheth out her hand to the poor; yea, she reacheth forth her hands to the needy. She is not afraid of the snow for her household: for all her household are clothed with scarlet.” (Proverbs 31:20-21).

The Virtuous Woman maintained an important balance as she handled her finances. She made sure her family’s current and future needs were well taken care of, and she was also known for her generosity and care for others beyond the walls of her home.

When a person is struggling financially, the natural reaction is to self-protect by cutting back on giving, perhaps even cutting it out completely. This might make sense in human wisdom, but as Christians, we know that in God’s economy, we give because it demonstrates our love for and trust in Him, and He abundantly blesses those who faithfully give even out of their poverty (Proverbs 11:24; Malachi 3:8-12; Luke 21:1-4; 1 Corinthians 16:1-2; 2 Corinthians 8:1-5).

I am thankful to have parents who taught me from a very young age – I started my first paper route when I was 7 or 8 – to give to God from my income before spending or even saving. They taught me to tithe and give offerings, and they didn’t teach me just with words – they lived out incredible generosity through many very lean years as they raised my 11 siblings and me on a meager pastor’s income. I say “lean years,” and they were; yet we never went hungry, we always had clothes to wear, toys to play with, and lots of stories to tell of times when we had seen Jehovah-Jireh (the God Who Provides) provide for us.

Not only did my parents teach me to give, but they also taught me to save. My dad took me to the bank to open checking and savings accounts when I was barely tall enough to see over the counter. As an adult, I’ve more fully understood the importance of balancing giving and saving as I’ve witnessed the principles my parents taught me play out in my life and the lives of others I’ve observed.

I’ve known people who lived generously but never saved or invested in the future. Once they were elderly and could no longer work, they were entirely dependent on the continued financial support of others to keep the lights on and food on the table. On the other hand, I’ve had young couples tell me they would start giving when the “next raise comes,” and elderly people who were vocal about how they couldn’t possibly afford to tithe, let alone give offerings because they were on a “fixed income” and simply had nothing to spare.

What a person gives or does not give, saves or does not save, is between themselves and God (Matthew 6:1-4), but both these extremes of financial imbalance break my heart. Stewarding our money and other resources with both wisdom and generosity while remembering that everything we own is ultimately on loan from God helps us keep a God-honoring perspective on finances and protects us from falling into a ditch of being overly frugal or foolishly openhanded.

With wise biblical stewardship, we can both give and save. As we do, we will find ourselves in a place where not only are our own needs met, but we can also be a large conduit through which God sends provision to others.

Each Ordinary Moment

I believe with all my heart that with wise biblical stewardship, we can both give and save and that as we do, we will find ourselves in a place where not only are our needs met, but we can also be a large conduit through which God sends provision to others.

Financial Stewardship in Action:

Long ago, I heard this sensible advice for maintaining a healthy balance between generosity and setting funds aside for the future: match your giving with your saving. For instance, if you save 10% of your income every month (this is an excellent goal to shoot for), balance that with giving at least 10% of your income (also called a tithe).

If you are not currently saving or giving, it’s time to take a good hard look at your budget. Advice on working out a budget (also called a spending plan) is beyond the scope of this article, so please check out the helpful resources available through FaithFi or other reputable Christian financial advisors.

Above all, ask God to help you to grow in your faith as you wisely save for the future (Proverbs 6:6-8; 13:22) and give generously even when it seems that you have nothing to offer; remember, He is the God who multiplies our tiny offerings, our “loaves and fishes” (Matthew 14:14-21; Hebrews 13:16).

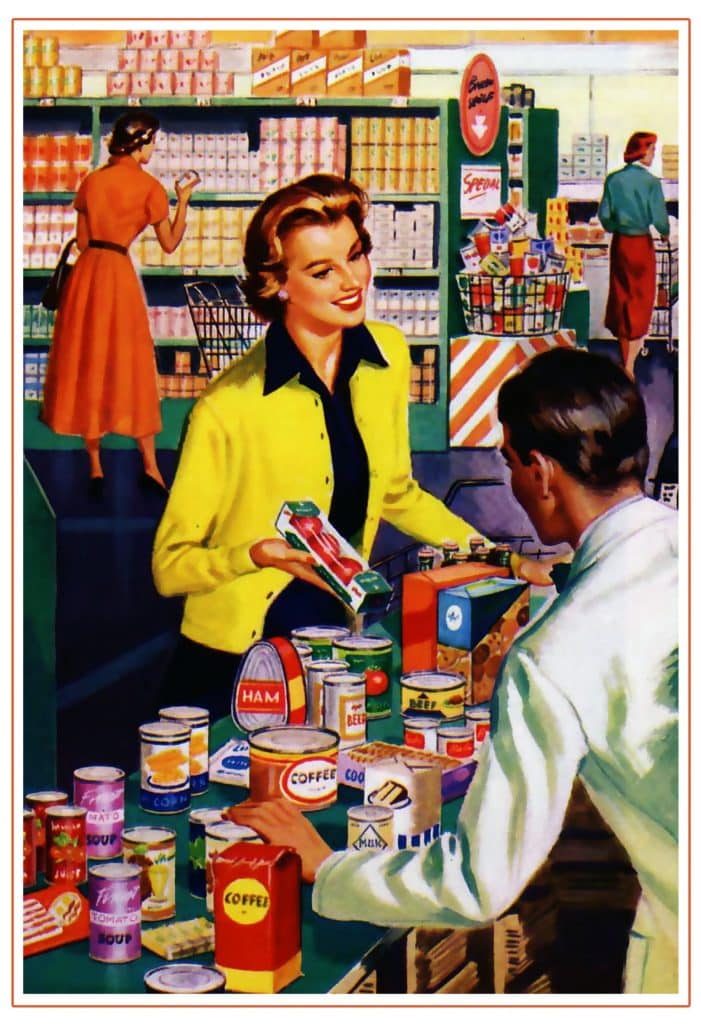

Principle 3: Shop Savvy and Spend with Intention

“She seeketh wool, and flax, and worketh willingly with her hands. She is like the merchants’ ships; she bringeth her food from afar. She considereth a field, and buyeth it: with the fruit of her hands she planteth a vineyard.” (Proverbs 31:13-14, 16)

Like a shrewd merchant who sails the seas looking for valuable, quality goods at reasonable prices, we read that the Proverbs 31 woman “seeks” wool and flax and “brings her food from afar.” She also made careful, well-thought-out investments in her future, including purchasing land on which she could plant a vineyard that would provide food and potential income for her family in the years to come.

The Virtuous Woman was willing to put time and effort into finding the things she needed at the best value possible. She also thought through her purchases – she wasn’t just scrolling strolling idly through the market, popping this and that into her Amazon cart woven basket, whether or not the item was needed. She didn’t naively part ways with her money but, instead, made sure that what she was buying was priced right and that it was within her budget.

Never in the history of humankind has it been so easy for us to spend so glibly – with a click of the mouse or two clicks of the side button on our phones, we can buy goods from across the ocean or down the street, and have them delivered to our front door. This is both a blessing and a danger. A blessing in that we can easily find and purchase the things we need, and a danger in that we can easily find and purchase a whole lot of things that we don’t need and cannot afford. If ever we needed to know how to be savvy and intentional shoppers, it is now.

Exactly how you will live out this principle in your homemaking will vary depending on your particular season of life, location, and family circumstances. If you live in an urban area with many grocery store choices, it may look like scouring the sales flyers for what’s on sale and maybe clipping coupons. If you live in a rural area it may look like shopping online for much of what you need and comparing prices between a few online stores before you hit “check out now.”

The word “savvy” means “Having or showing perception, comprehension, or shrewdness, especially in practical matters; practical know-how.” While it takes time to be a savvy and intentional shopper, you will reap dividends as you grow in your skills and find what options work best for you.

For example, I don’t have access to paper coupons to clip since I don’t get circulars in the mail. Still, I can check for online coupons on Walmart and Amazon (I order much of my regular necessities through Amazon Subscribe and Save, and there are often digital coupons available). One of my sisters is the queen of finding thrift store deals, saving a lot of money on clothes for her family. I’ve found a couple of trusty consignment stores where I regularly (and quickly) shop for specific items I need. One of my friends finds great deals on Facebook Marketplace, while another friend is fantastic at hitting the clearance racks at retail stores and often finds better prices on brand-new clothing for her kids than she could find at a second-hand shop. There are many ways to “be like a merchant ship,” and you don’t even have to sail the high seas to do it!

However you shop, and no matter how many people you are shopping for, as a wise homemaker, be purposeful about finding sources for healthy and affordable food and quality clothing for yourself and your family as you seek to wisely steward the resources entrusted to you.

Financial Stewardship in Action:

Start with being honest with yourself – on a scale of 1 to 10, with 1 being “I have no idea where my money goes every month” and 10 being “My checkbook is always balanced, and every cent I spend is accounted for,” where do you fit?

Next, identify some concrete steps that you can take to move closer to where you want to be on that scale. Here are a few ideas:

- If spending money is a little too easy for you, consider removing shopping apps from your phone, not storing your credit card information on shopping sites, and heading into a store with only the amount of cash that you actually have room in your budget to spend. A couple things that have helped me to be more mindful while shopping on Amazon are to not have Amazon Prime and to automatically load a gift card every month so I have a clear picture of exactly how much I have already spent and how much I still have available to use for the rest of the month.

- Keeping four boys in reasonably unstained and unripped clothing can be challenging for me! I have learned to LOVE getting other people’s gently used hand-me-downs. Some other ideas for finding clothing deals include locating a nearby thrift or consignment store that you can stop in at, checking into some online options such as eBay or ThredUp (I bought most of my baby and toddler clothes this way, often in a “lot” of a specific size). Keep a list of the sizes and measurements of your family so that you are prepared to shop sales at new or online stores if you notice they are having a sale on items you need.

- Online grocery shopping has been a lifesaver (and cash saver) for me in my current season of raising four ravenous boys. If you aren’t already using a grocery pick-up service, and it is available in your area, please give it a try! Looking at the prices of something online lets you quickly check prices between two or three stores (i.e., Walmart grocery pick up and Amazon Subscribe and Save). Plus, you can see your total before you check out, making it much easier to stay within your grocery budget for the week or month.

For many of us, the current economy and rising inflation have made it absolutely necessary to learn to be savvy and intentional with our money. I’m on the journey with you, and this is an area that I am continuing to learn and grow in, so I am excited to share with you some excellent advice that I received from fellow homemakers when I asked what their best money tips and or biggest struggle was. Here is a collection of real-life advice from women learning to be good with money.

Practical Financial Tips (And Real-Life Struggles) from Smart and Frugal Homemakers

“Financial struggles are widespread, and they can be destructive. I am grateful to my husband for his insistence on eliminating debt. Mortgage, car payments, credit cards — We sometimes utilize these during those hungry years. But you cannot carry them into retirement. A steady plan to save early and reduce debt completely can save many families from ruin.” – Grammye

“Always save money from every paycheck. Eventually, a car, an appliance, a window in your home will need to be replaced. Plan ahead for such expenses. Learn to make do. We need fewer clothes than we think we need. Learn the difference between needs and wants. While dollar stores can be a money saver, not everything there is a good deal. Plus, because it’s not as expensive per item, it is easier to overspend there. Learn to cook from scratch. You will save money on grocery bills and possibly on doctor’s bills. Read old books. It’s amazing the good financial advice that can be gleaned from homemakers of the past. They meticulously kept track of every penny spent.” – Luba

“Meal planning, assigning money to ‘fun things’ and having a written budget!” – Jessie

“It’s one the toughest seasons for our family for various reasons. The Lord has taught me a lot over the years, one being to not let finances rob my joy and peace.” – Christina

“My biggest struggle…inflation and groceries! This has been a terrible year just trying to get the ends to meet (and they haven’t yet!). Financial tip? We use as many non-consumable items as possible: cloth napkins, cleaning rags instead of Lysol wipes, homemade cleaners, dryer balls instead of dryer sheets, canning jars for food storage instead of ziplocs (and wash/reuse the ziplocs we do buy!). I use the clothesline when possible, and we keep the house cold in winter. But it doesn’t seem to be helping much anymore!” – Andrea

“Tithe first, Faith Promise next, pay bills, and live by faith on what is left. Grocery-wise: Go early to the store for the markdowns that day. I plan meals according to the meat on sale, which often happens at the store. Our stores have digital coupons you can clip on the app. Also, I make sure we have cheaper staples such as peanut butter, oatmeal, rice, beans, and tuna on hand. Cereal only two days a week…usually Monday and Thursday (those seem to be our tired mornings). At least one night a week, we plan a meal without meat such as red beans and rice, or vegetable soup and cornbread. We grow a garden and eat leftovers. We also have a local church that has free meat on certain days and produce on other days. It is just going out of date.

Clothing-wise: After closet clean-outs each season, I make a list and pray over it, and often find just what is needed at Goodwill or another discount store. I also make a list and ask the Lord for what is needed. Sometimes, I have kept it on my nightstand…it helps me remember to petition the Lord each night before bed.

Starting our lives over has not been easy financially, and many of our worldly goods were left behind. However, the Lord has taught me that we can live with much less, and some things are just not important.” – Kristy

“God has been dealing with me a lot about applying Prov 3:5-6, and acknowledging Him in everything rather than counting on my own schemes and ideas. I have a long way to go though …” – Suzanne

“Tip: Don’t ever buy on credit or use a credit card. Struggle: Creating a budget and sticking to it.” – Zaynab

“The tip that has helped me the most is to not meal plan! I go to the grocery store and buy what’s on sale, refill kitchen staples, then plan my meals with what I have. It’s much easier to stick to a budget when you can be flexible with your shopping.” – Julia

“We have been married 31 years and have been completely debt-free (including the house) for a significant part of that. My #1 tip is to make friends with the word “no.” No to the “buy two get one free earrings” when you only need one pair. No to the new Keurig when the Mr. Coffee you got as a wedding gift works fine. No to a new dress for the event when you can wear the one from last year. No to the house that your bank says you can afford when you know that will stretch the budget to pay that mortgage. No to the brand-new car just because the interest rate is great when you can buy the used car with cash.

A thousand “nos” strung back-to-back will eventually lead to being completely debt-free. And then you can say all the yesses. YES to the cool new coffee machine and the pretty new car and 3 pairs of earrings. Or as Dave Ramsey says, “Live like no one else so that later on you can live like no one else.” – Sandy

One Last Word on Financial Stewardship

I hope you’ve found this look at wise biblical financial stewardship helpful and that you also enjoyed reading the advice and honest financial struggles of other homemakers like you. Talking about money can often be an uncomfortable or guilt-ridden topic, but it doesn’t need to be. The Bible is full of sound financial wisdom, which we have barely touched the tip of in this post. I encourage you to dig deep into Scripture to discover more of what God says about managing our money God’s way.

What does it mean to be good with money? It means that you are trustworthy and honest in your financial dealings. It means that you are living with generosity while also prudently preparing for the future by consistently saving. And it means you are a savvy and intentional shopper, spending your dollars with thought and care.

Most of all, being good with money means that we remember that every good gift is from above, and so we seek to be wise stewards of our resources as we look forward to the day when God will say, not just of the way we spent our money, but of the way we spent our lives, “Well done, good and faithful servant.”

Each Ordinary Moment

Most of all, being good with money means that we remember that every good gift is from above, and so we seek to be wise stewards of our resources as we look forward to the day when God will say, not just of the way we spent our money, but of the way we spent our lives, “Well done, good and faithful servant.”